RPM Manual

The practical 2026 guide to device rules, day thresholds, management time, and audit defensibility for Remote Patient Monitoring.

Read the RPM Guide →What the new Advanced Primary Care Management rules actually mean for independent practices--and why the era of the outsourced audit risk is ending.

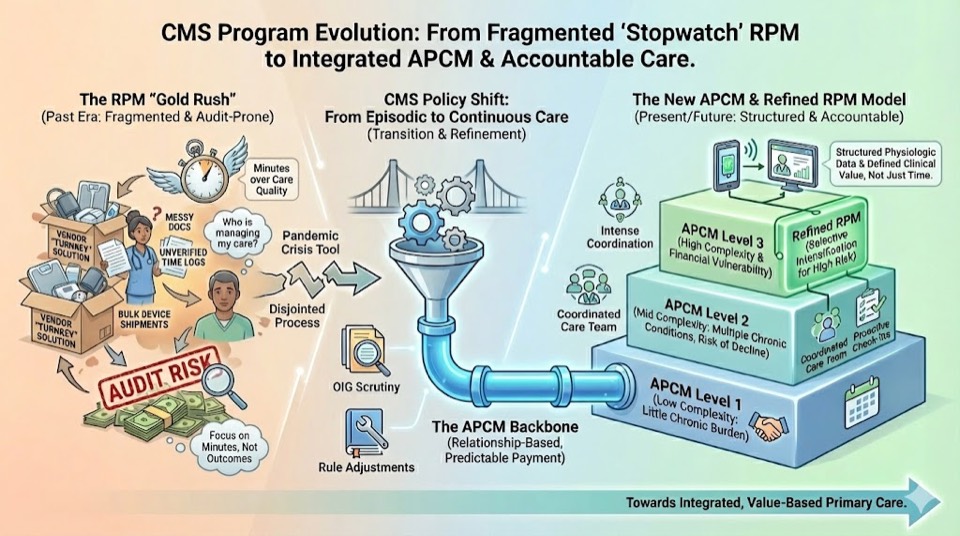

For the last five years, Remote Patient Monitoring (RPM) has been the “Wild West” of healthcare. Venture-backed vendors flooded the market, promising practices easy “mailbox money” in exchange for handing over their patient data and billing rights.

As we move into the 2025–2026 cycle, CMS is signaling a massive shift. With the introduction of Advanced Primary Care Management (APCM) and tighter scrutiny on traditional RPM, the era of the outsourced vendor is ending. The new era is about technologically enabled independent practices that keep revenue and oversight in-house.

Who this guide is for

Independent practices, RHCs/FQHCs, medical directors, and billing/compliance leads who want to keep RPM/RTM/APCM revenue while staying off the OIG’s radar and reducing dependence on full-service vendors.

How to use it

Use sections 1–4 to understand how CMS is repositioning RPM and APCM, sections 5–6 to stress-test your current workflows, and the FAQ to brief clinicians and leadership without having to summarize the rules yourself.

During the COVID-19 Public Health Emergency (PHE), regulators loosened the reins to keep patients home. It was necessary--but it also created perverse incentives that vendor-driven RPM models eagerly exploited.

Most vendor offerings optimized for volume, not care. They prioritized:

The result: The Office of Inspector General (OIG) has flagged massive amounts of waste, specifically citing missing care plans and duplicate billing. When the audit comes, the vendor does not sit in front of the auditor. The practice is liable, not the vendor.

CMS has not banned remote care. Instead, they are restructuring how they pay for it--moving from device-driven payments to management-driven payments.

APCM is a new set of billing codes (G0556, G0557, G0558) designed to bundle care-management services into a streamlined, risk-adjusted monthly payment. Unlike traditional fee-for-service RPM--which requires strict time logging and device data counts--APCM focuses on the availability, continuity, and comprehensiveness of the patient’s primary care.

For independent practices, this is a game-changer. It reduces the click-burden of minute-logging, shifts focus to team-based primary care, and returns clinical quarterbacking to the primary care provider instead of a vendor call center.

For an independent practice, the economics of running remote care in-house have drastically improved under the 2025–26 rules.

If you have 500 patients on RPM, a 50% vendor split could be costing you $15,000+ per month in lost revenue.

Run the free Vendor P&L Analyzer →Is RPM going away? No. But it is changing roles. In 2026, RPM should no longer be a blanket strategy where you enroll every patient with a pulse. It becomes a targeted clinical tool.

By treating RPM as a supplement to APCM, you solve the compliance problem (medical necessity is obvious) and the audit problem (you aren’t billing for data nobody reviews). RPM becomes a high-yield signal generator inside a broader APCM program, not the program itself.

To capitalize on the 2025–26 rule changes, you don’t need a partner who takes half your check. You need a system that makes APCM and RPM compliant by design.

A properly structured in-house program should cover three core capabilities:

Don’t guess which patients qualify. Use software that scans your panel against payer rules (Medicare, MA, and key commercial policies) to identify candidates for APCM, RPM, or CCM automatically. This prevents over-enrollment, under-billing, and missed revenue.

CMS and payer rules change. Your software shouldn’t break every time they do. Instead of relying solely on staff training and PDFs, use a system with clinical and billing rules baked into the workflow.

Your staff cannot live in five different vendor portals. Data from patient devices and APCM workflows should flow into a single dashboard that highlights exceptions (who is worsening, who missed follow-up, who needs a medication change), not just volume (who stepped on a scale).

With exception-based automation, one trained staff member can realistically manage hundreds of patients across APCM, RPM, and CCM without drowning in clicks.

Whether you use a vendor or go fully in-house, if you can’t check these boxes, you are exposed. Use this as a quick reality check for your current workflows.

The HHS Office of Inspector General has already published evaluations showing high rates of missing RPM components (setup, device, management), device-only billing, and duplicate enrollee patterns. A dedicated Part B RPM audit is on the OIG work plan for the 2025–26 cycle. Treat this checklist as your pre-audit filter: if an auditor pulled ten random charts, would you be comfortable handing them over?

The 2025 CMS rules are a gift to independent practices--but only if you adapt. The “easy button” of signing up with a predatory vendor is gone. The new path requires you to own your data, your workflows, and your compliance.

By keeping remote care in-house and aligning RPM with APCM, you protect your patients from harassment, protect your practice from audits, and keep the revenue where it belongs: with the providers doing the work.

Get a concrete list of what an RPM/APCM auditor will look for in 2026.

Download the 2025–26 Audit Survival ChecklistQuantify how much vendor revenue-share is costing your practice every month.

Use the Vendor Profit AnalyzerLearn how FairPath automates APCM and RPM in-house, with compliance as code.

See the FairPath APCM ProgramNo. APCM is an alternative or additive payment model for comprehensive primary care management. RPM remains valid for specific physiologic or therapeutic monitoring needs. The most defensible strategy is a hybrid: APCM as the base for ongoing management, with RPM as a targeted supplement when real-time data are clinically necessary.

It changes the workload more than it increases it. Instead of chasing vendors for reports and reconciling external portals with your EHR, your staff manages care inside a single workflow. With exception-based automation, one staff member can support hundreds of APCM/RPM patients by focusing on outliers rather than micromanaging every reading.

Maybe--but do it deliberately. Review your contract for term, termination, and data-ownership clauses. Many vendor agreements are misaligned with the new transparency expectations and do not support APCM billing.

That may give you leverage to renegotiate or to plan a staged transition where you run FairPath in parallel while you unwind the legacy program and preserve your in-house APCM and RPM workflows.

The OIG’s RPM work has consistently highlighted the same patterns: patients without a prior relationship to the billing provider, device-only months with no documented management, duplicate billing across practices or vendors, and claims that don’t match the documented days of data or minutes of work. If your program has clear eligibility criteria, documented medical necessity, complete time and device logs, and one accountable owner per patient, you are already ahead of the highest-risk cohort.

They are increasingly hard to defend. Any model where a third party is paid more as you bill more--especially when that party controls outreach, scripting, and documentation--raises Anti-Kickback and False Claims questions. Even if a vendor’s attorney signs off on the contract, regulators will still hold your practice responsible for the claims billed under your NPI. That is why many groups are moving to a vendor-free model with flat software fees and full visibility into every minute and device day.

While most platforms simply record what happened, FairPath actively runs the program. It continuously monitors every patient, staff action, and billing rule across CCM, RPM, RTM, and APCM, intervening immediately when a requirement is missed.

This allows you to scale your own program without losing quality, breaking trust with physicians, or losing control of your revenue. We provide the precision of an automated medical director without the chaos.

FairPath is built on operational work, not theory. We publish the playbooks and checklists we use to keep programs compliant and profitable. Use them whether you run FairPath or not.

Browse the Expert Library →The practical 2026 guide to device rules, day thresholds, management time, and audit defensibility for Remote Patient Monitoring.

Read the RPM Guide →How to run Remote Therapeutic Monitoring for MSK, respiratory, and CBT workflows with the correct 9897x and 9898x rules.

Read the RTM Guide →Calendar-month operations for CCM: consent, initiating visit, care plan requirements, time counting, and concurrency rules.

Read the CCM Guide →The operator blueprint for Advanced Primary Care Management: eligibility, G0556–G0558 tiers, and monthly execution.

Read the APCM Playbook →